Recap –

After a long rally market needs to take some rest and consolidate. The exact

same thing occurred today. Market opened gap up and gave move in first one hour

after that it was just a sideways day. It’s tricky to trade on long side as

risk reward is not favourable after a gap up.

Market Context for Tomorrow –

Expect a sideways day tomorrow as well

unless we break the previous day lows in indices. The playground on upside is

open as we are already making new all-time highs but we cannot simply jump on long

side as risk is higher on upside given that market is moving in gaps and

already we have witnessed a good rally in past weeks. It has to give some

pullback and definitely it will come in this week where we can see some gap

filling. Till then it’s better to just observe the market rather than taking

random trades.

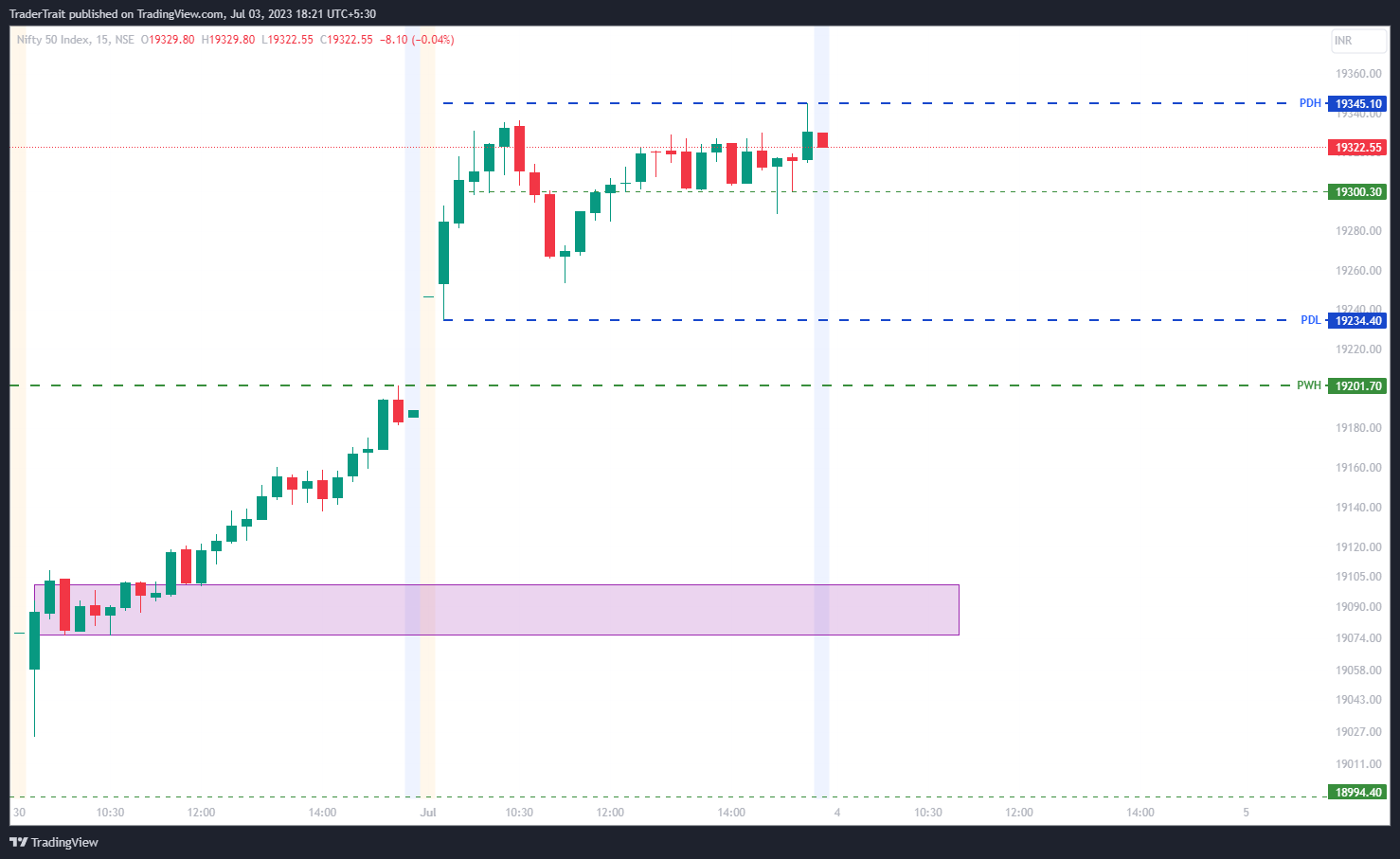

Nifty50 –

Keeping it short and simple for

tomorrow. 19300 is the level to watch.

If Nifty is taking support near this level

(at least wait for thirty minutes), we can plan for long trade with targets

upto 19350, 19400.

Below this level targets will be 19240,

19200.

BankNifty-

CNXFinance (Fin Nifty)-

In FinNifty, below 20250 we can expect

some good moves till 20100. Keep targets at every 50-60 points.

If it opens gap up, then wait for price

to sustain at 20250 before initiating any long side trade.

Chart for reference-

Abbreviations used in Chart-

PDH – Previous day High

PDL – Previous day Low

PWH – Previous Week High

PWL – Previous Week Low

PDC – Previous Day Close

NOTE: THIS BLOG IS ONLY FOR EDUCATIONAL

PURPOSES. TRADE WISELY.

Comments

Post a Comment